8 Easy Facts About Retirement Planning Shown

Having a savings in position is the ideal remedy. When your future is more secure, your existing will certainly be also. Without a retirement in position, if you are saving up for retired life in a careless method (state, such as saving extra adjustment in a piggy bank and dumping it right into a financial savings account every couple of months) you are even more most likely to use and also abuse those cost savings than if you have a concrete and inviolable plan.

There is also a particular benefit of sensation economically secure that aids people make far better decisions in the existing moment. If you do not believe it, just consider exactly how you may really feel if you were heavily in the red (especially credit history card debt). Equally as being entraped under the concern of revengeful interest repayments makes it tough to believe and prepare plainly, however having a substantial savings for the future will feel like a breath of fresh air during your functioning years.

There's no shame in counting on household members when you truly need them. In America there is a whole spectrum of point of views on proper borders with extended family participants and also in-laws. You can not (or should not) expect to depend on your youngsters to deal with you monetarily or in reality.

It is essential to bear in mind that by the time you retire, your youngsters might have youngsters of their own that they need to support, which implies that if they likewise require to sustain you, you're putting them into something widely called the Sandwich Generationa team "sandwiched" in between the financial obligation of looking after their youngsters and also caring for their parents.

Unknown Facts About Retirement Planning

With a retirement in area, you'll have even more cash to provide as you get ready to leave a tradition. Having a retirement in position may not be the important things that solutions your marital relationship, however it can definitely assist. As you might think, national politics, intimacy, child rearing, and cash are amongst the biggest provocateurs of debates in a married pair.

Do not put the financial safety and security of your gold years off any type of longerschedule a free appointment with useful content an Anderson professional today! - retirement planning.

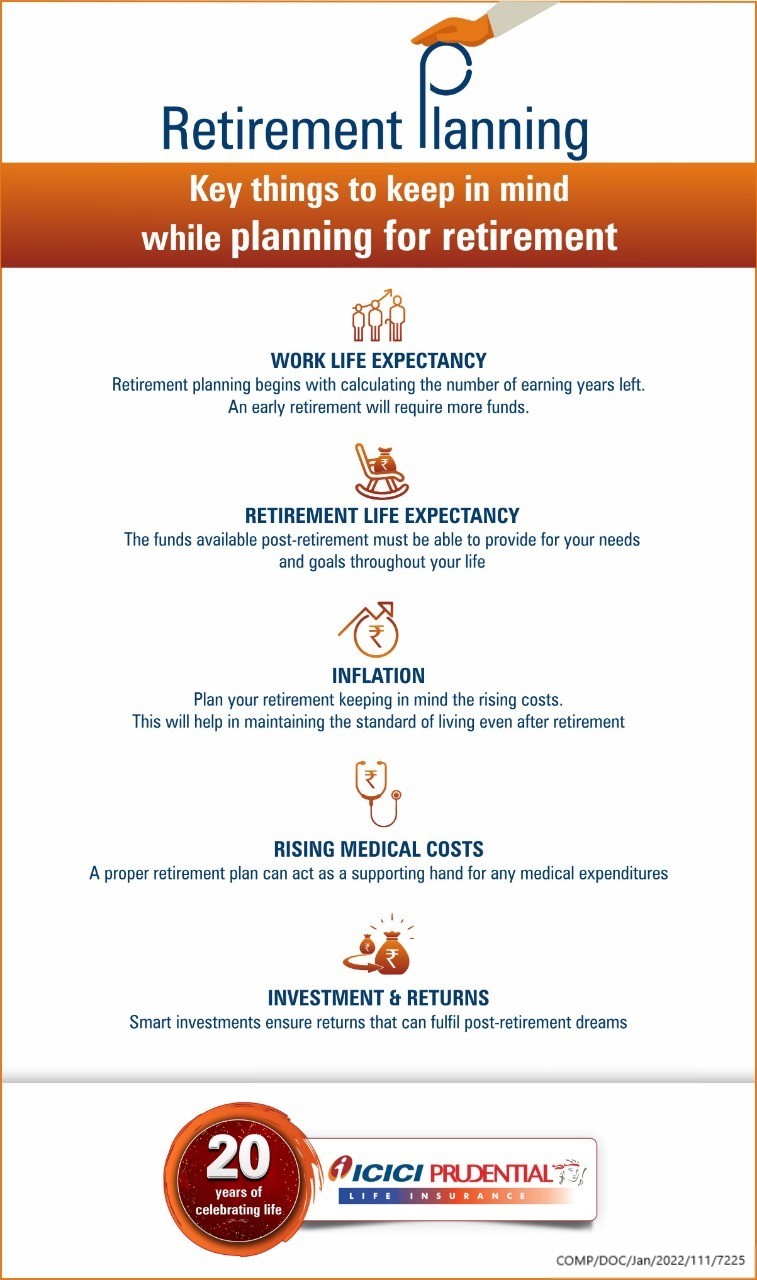

Right here are a few of the main factors why retirement planning is essential. Review: 10 Creative Ways to Make Cash After Retired Life Inflation is driving the price of living to new elevations; today's regular monthly spending plan will not be sufficient to cover your once a week budget in 25 or three decades when top article you retire.

The investments ought to be long-term and also fairly low-risk that can stand up to recessions, like genuine estate as well as federal government bonds. Discover more >> Climbing Inflation: Where Should You Keep, Spend Your Money? While the majority of employees favor to work until they hit the obligatory old age of 60, sometimes, these strategies can be interrupted.

The Ultimate Guide To Retirement Planning

You can rollover that expertise to various other locations of life. For instance, you can duplicate your successful retirement financial investment approaches in your various other spending objectives, such as getting a house. It will certainly help you build riches as well as retire rich. Planning for retired life will certainly help prepare your estate to line up with your life tradition.

You can maintain your wide range and also leave it to your dependents, that you trust will proceed your tradition. Investing in realty and also obtaining life insurance policy can leave your dependents monetarily established after you are gone. Likewise check out: What to Do If You Lose Your Revenue Mid-Career? After retiring, the ideal point you can do for your family members is not problem them financially.

You should be the individual helping your youngsters spend for your grandkid's education as well as such. Depending upon your kids look at this website financially after retirement and having them pay "black tax obligation" can considerably impede their economic growth, developing a generational hardship circle. Even worse, it can add to disunity in the family members. retirement planning. Retired life preparation will assist you develop safeguard from where you will be creating income after retirement to sustain on your own and not problem others with your economic needs.

Without enough preparation and also monetary planning, it can feel like jail. Planning for retirement can aid you afford to complete points and also attain desires you could not while functioning.

The 2-Minute Rule for Retirement Planning

Comments on “Unknown Facts About Retirement Planning”